Hey, my dears! "BHIM UCO UPI" is awesome! This official app launched by UCO Bank meets all banking needs. It uses Virtual Private Address (VPA) to make payments and collections, and each customer account has a unique VPA. It can be downloaded and installed on mobile phones or tablets, and registered for encrypted communication with the National Payments Corporation of India. It can add bank accounts, verify and set MPIN, make payments and collections, check balances, etc. It can also initiate payment requests and check transaction history. UPI uses multiple payment methods to meet the vision of "reducing cash". As part of digital banking, QR codes are also introduced to facilitate fund transfers, which is a healthy alternative to POS.

UCO Bank has launched the official UPI (Unified Payments Interface) app to cater to the various banking needs of its customers.

UCO Bank is a commercial bank and an agency of the Government of India that provides a variety of services to its customers.

BHIM UCO UPI enables customers to make or receive payments through Virtual Private Address (VPA).

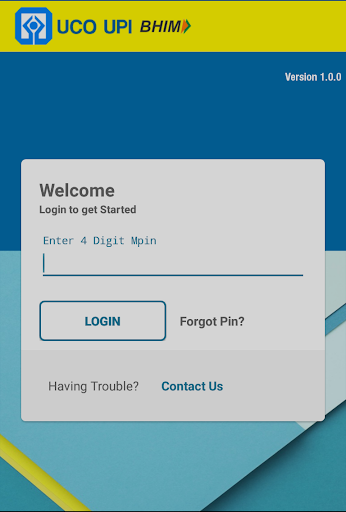

Each customer's account has a unique VPA. Customers can download the UPI app and install it on their devices (mobile/tablet).

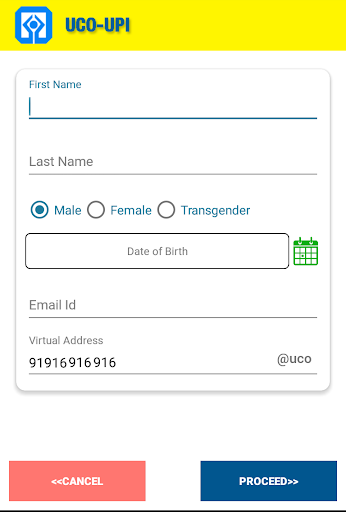

While registering, the UPI app communicates with the National Payments Corporation of India (NPCI) in an encrypted data format. Customers need to create a virtual address and complete their profile information.

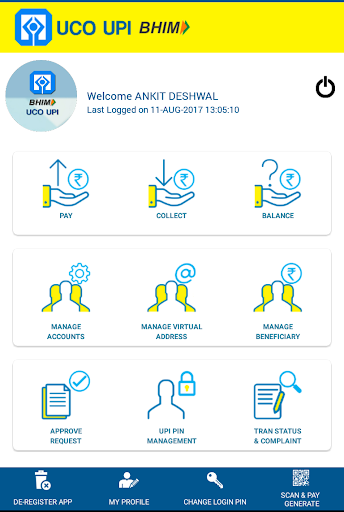

Customers can add UPI enabled bank accounts based on their mobile number registered with the bank. After adding the bank account, it needs to be verified and set up MPIN using debit card information and one-time password (OTP). After debit card verification, customers can make or receive payments to other bank accounts. Customers can also do balance enquiries.

UPI uses IMPS as its foundation and customers can make payments using P2P (via the sender's MMID and mobile number), P2A (via IFSC code and account), P2U (via AAdhar payment) and VPA (Virtual Private Address).

Customers can also initiate a request to receive money from other UPI customers. The request will appear in the "Collect Authorisation" option and the user can accept or reject the request.

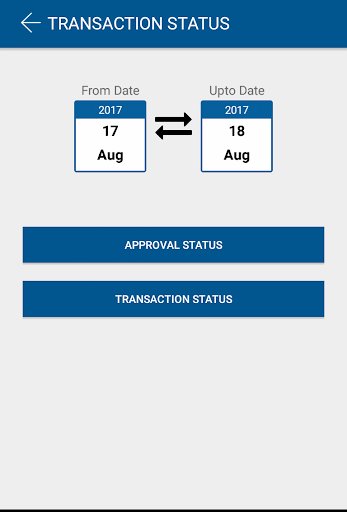

The transaction history will show details of all payment and collection requests. By adding a beneficiary, customers can add beneficiaries of other banks for payment. UPI allows payments to be initiated by either the payer or the beneficiary. In the basic beneficiary-initiated flow, the payment request is routed by the initiating application through the NPCI switch to the payer for approval.

However, in some cases, if the payer can be connected immediately, the beneficiary initiates the payment request and the payer can use his credentials to initiate the payment request. UPI is an architecture and a set of standard APIs to facilitate the next generation of online instant payments, leveraging the trend of smartphone penetration, Indian language interfaces and the ubiquity of the Internet and data.

UPI was launched by the National Payments Corporation of India (NPCI) in line with the Reserve Bank of India's vision of a 'less cash' and more digital society. NPCI is built on the Immediate Payment Service (IMPS) platform, adding a layer that makes debits easy even on mobile phones.

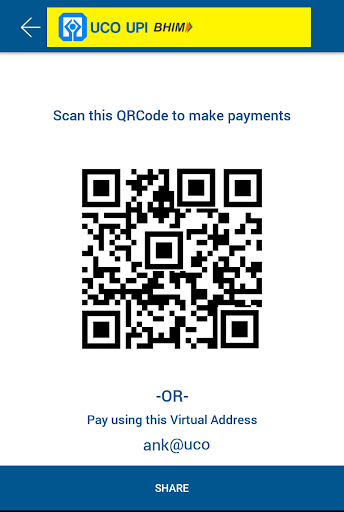

As part of digital banking, UCO Bank has also introduced QR codes for its BHIM UCO UPI, which will help in quick fund transfers and serve as a healthy alternative to POS (Point of Sale).